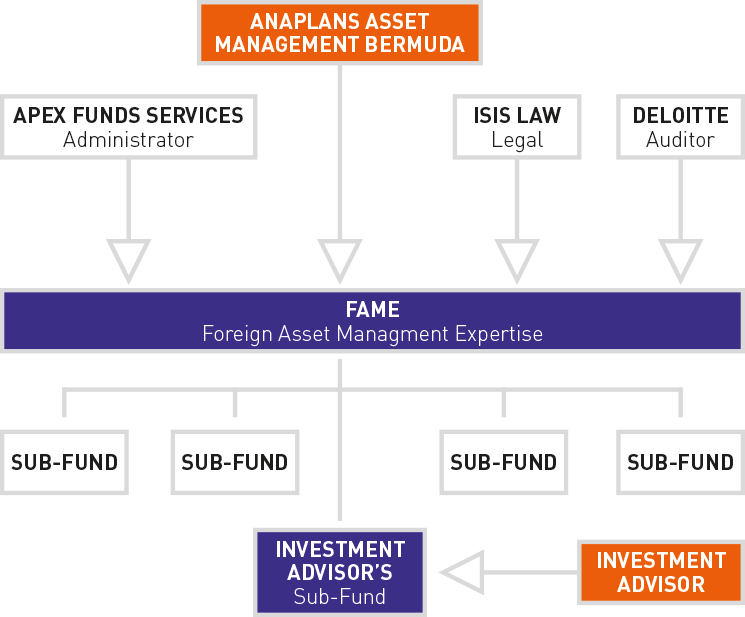

FAME have engaged globally recognized international services providers covering administration, accounting & investor reporting, legal representation and auditing the Sub-fund. We have very favorable terms and conditions in place giving Investment Managers/Advisors the benefit of FAMEs solid relationship with globally recognized providers.

Apex Funds Services (Apex)

Apex is AICR Fund Administrator and one of the world’s largest independent fund administration companies with over $28 billion of assets under administration, 34 offices and 370 employees across the globe.

Apex monitors and records all corporate actions relating to the Credit Receivables transactions & maintains books and records of the AICR Fund in accordance with the funds governing documents.

Anaplans Asset Management Bermuda (AAMB)

AAMB is FAME’s Investment Manager responsible for the overall management of the Mutual Fund platform & keeping the total expense ratio (TER) of Sub-funds down.

AAMB ensures that the Mutual Fund platform complies with Bermuda laws and regulations and that the Investment Managers/Advisors comply with the terms of the offering documents and Bye-laws.

Investment Advisor (IA)

You or your Investment Firm is the Sub-fund Investment Advisor responsible for the day to day management of the portfolio and the Funds’ performance.

Deloitte Touche Tohmatsu Limited (DTTL)

Deloitte Malta is the Auditor of AICR & a member of DTTL with 250 Maltese members of staff and supported by a globally connected network of tens of thousands of dedicated professionals in more than 150 countries.

ISIS Law Limited (ISIS)

ISIS is the Legal Advisor (Bermuda Law) of AICR & a member of the ISIS Law Group with a legal team of lawyers who have previously practiced at leading law firms in Toronto, Canada, London, England and Hong Kong.

The Sub-fund will need to appoint a Custodian and Prime Broker although the requirement to appoint a Custodian can be waived if there are appropriate alternative arrangements in place for safeguarding of the Sub-fund property or if the Sub-fund is a feeder fund.

FAME Legal Structure

The FAME Bermuda platform is incorporated as segregated account/ portfolio company and is authorized as mutual fund. The segregated account / portfolio company structure allows the Platform to establish separate Sub-funds each of which is a segregated account/ portfolio and its assets and liabilities are segregated or ring-fenced from the general assets of the Platform and the assets and liabilities of outer Sub-funds on the Platform. This concept of segregation is recognized as a matter of statute and is supported by recent case law. The establishment of a Sub-fund does not create a separate legal person. The Platform remains the legal person with the capacity to enter into transactions or contracts relating to the Sub-fund.

Investors receive participating shares in the Sub-fund which are non-voting. Anaplans Asset Management Bermuda Ltd (“AAMB”)* owns the management shares which are voting shares.

The FAME Bermuda platform is regulated by the Bermuda Monetary Authority The regulator may require such information or explanation in respect to the Sub-funds as may be reasonably required by them to enable them to carry out their regulatory duties and may require access to the records of the Sub-fund.

Audited financial statements must be prepared for the Sub-fund and these are submitted to the Regulator.

* Anaplans Asset Management Bermuda Ltd (“AAMB”) is responsible for the overall management of the Mutual Fund platform & keeping the Sub-funds total expense ratio (TER) down.

AAMB ensures that the Mutual Fund platform complies with Bermuda laws and regulations and that the Investment Managers/Advisors comply with the terms of the offering documents and Bye-laws.