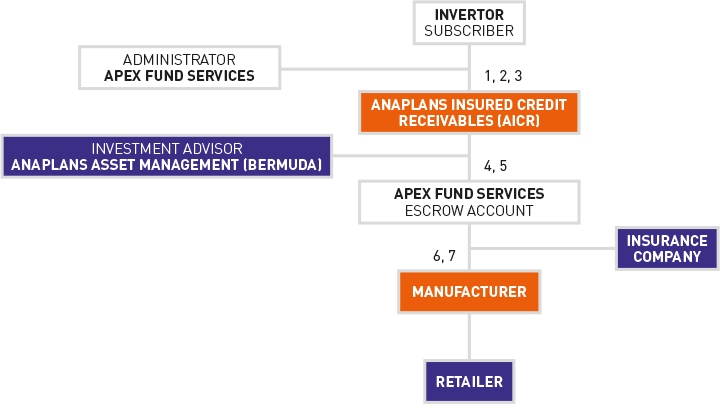

The following is the Investment flow chart and the legal documents holding:

- Investor purchases shares in Anaplans Institutional Insured Credit Receivables Fund (AICR)

- The money is received by Apex Fund Services on behalf of AICR

- The Administrator records Investor/subscriber in AICRs’ database for recordkeeping

- The Investment Advisor advises Apex Fund Services to release money from the Escrow Account to allow AICR to enter into Insured Credit Receivables transactions.

- The legal documents related to the Insured Credit Receivables transactions are held by Apex Fund Services on behalf of AICR

- The Insurance Company is conducting a Due Diligence on the Retailer before Issuing the Credit Receivable Insurance Policy to AICR

- The Investment Advisor is conducting a Due Diligence on the Retailer before releasing the money from the Escrow Account to the Manufacturer